The concept of NON – DOMICILE was voted and came into force back in 2015 as a measure of boosting the economy by encouraging foreign High Net Worth Individuals (HNWI) to become Cyprus tax residents.

The Law distinguishes between individuals which have their domicile of origin in Cyprus and non-dom individuals however, both should be tax residents of the Republic for the non-dom test to be examined.

Tax residents with their domicile of origin in Cyprus should pay Special Defence Tax on dividends and rental income, 17% and 2.25% respectively. In 2019 General Health System (GHS) was added on top equal to 2.65% (current rate 2020).

Non-dom tax residents pay only GHS equal to 2.65% capped at EUR 180.000 (2020 onwards). They avoid in full the 17% which the domicile individuals pay. As a result, the non-dom individuals are exempted from Special Defence Contribution.

*Dividend income on the Cyprus tax resident individual from a foreign company might be subject to dividend withholding tax in the country of origin.

*Net non-dom benefit compared to domicile is €170.000.

The Law also distinguishes between “domicile of origin” and “domicile of choice”. Domicile of origin is acquired at birth. Domicile of choice is retained by the individual who intends to live permanently and/or indefinitely in one particular place i.e. Cyprus.

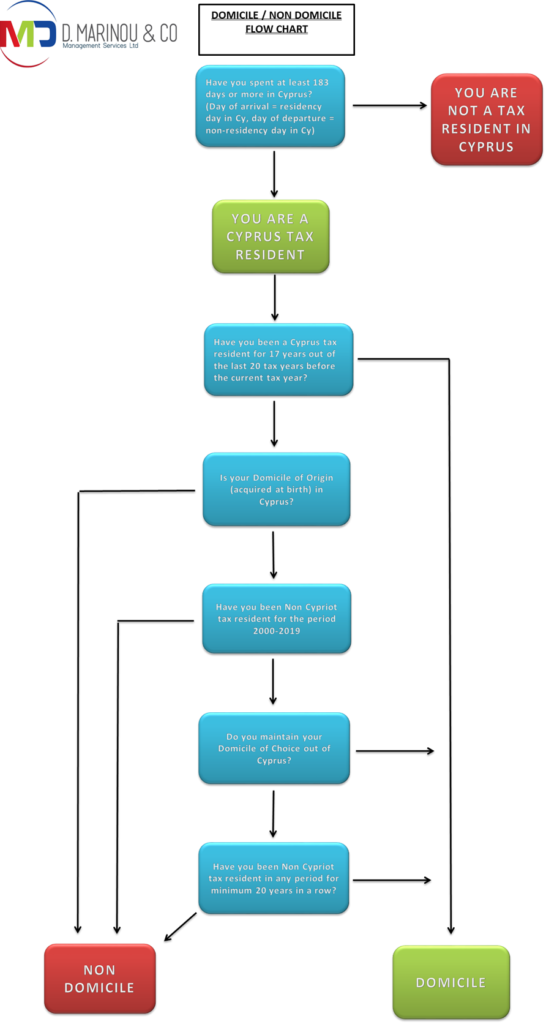

In summary an individual is considered domiciled in Cyprus by having his/her tax residency in Cyprus for 17 of the last 20 years prior to the relevant tax year independently of his/her domicile of origin OR by the fact that his/her domicile of origin is in Cyprus, unless:

- The person has acquired domicile of choice in another country, provided that he/she has not been tax resident in Cyprus for a period of 20 consecutive years prior to the relevant tax year.

- The person has not been tax resident in Cyprus for a period of 20 consecutive years prior to the introduction of the law, which came into force on the 17th of July 2015.

The distinction between domicile and non-domicile as well as the Cyprus tax residency status are illustrated on the below flow chart:

Finally, some of the proof the Tax Department may request for the tax residency status in Cyprus are the following: